Norton 360 Deluxe 2021 – Antivirus Software for 5 Devices with Auto Renewal - Includes VPN, PC Cloud Backup & Dark Web Monitoring Powered by LifeLock Key Card Visit the NortonLifeLock Store Platform: Mac OS Sierra 10.12, Windows 8.1, Mac OS X El Capitan 10.11, Windows 10, Windows 7. Norton 360 Deluxe 2021 – Antivirus software for 5 Devices with Auto Renewal - Includes VPN, PC Cloud Backup & Dark Web Monitoring powered by LifeLock Download Visit the NortonLifeLock Store Platform: Mac OS Sierra 10.12, Windows 8.1, Mac OS X El Capitan 10.11, Windows 10, Windows 7.

LifeLock provides identity theft protection for a wide range of needs. For those who have children, it is possible to add on LifeLock Junior, coverage for your minors. You can also create a plan that includes your senior parents, which gives you more insight into what is happening with your parents’ identity on a continuous basis. Combining these plans allows you to create a family plan that fits your unique needs.

LifeLock’s Individual & Family Plans

LifeLock offers three different levels of protection for individuals. This is where your family plan starts. You’ll need to choose the right level of protection for your individual needs, applicable to all adults. All plans offer the Million Dollar Protection Package**** which includes coverage for personal expenses incurred and money stolen as a result of identity theft, up to the limits of the plan you choose.

Here’s a look at some of the other features that are included in these plans.

LifeLock Standard Plan

The Standard Plan, which is $11.99 per month, includes:

- Up to $25,000 in stolen funds reimbursement****

- Personal expense compensation of up to $25,000 for your losses****

- Up to $1 million in coverage for lawyers and experts****

The Standard Plan features include:

- U.S. based identity restoration specialists to help you to restore your identity if it is lost

- 24/7 live support if you experience an identification breach

- Pre-approve credit card offer reductions to stop you from receiving offers

- Lost wallet protection

- Help to reduce your exposure to personal information such as your Social Security number, address, and other details

- Alerts for personal information on credit applications

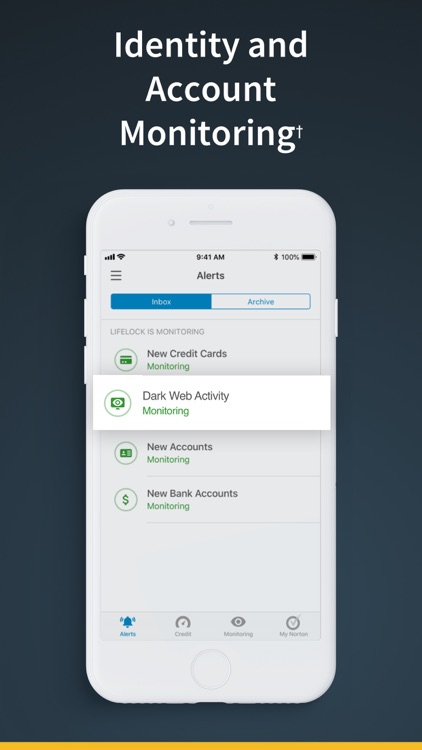

- Alerts for personal information that is found on the dark web

- Alerts for any change in address on the USPS

- Fake personal information alerts if there is some identity risk

- One credit bureau monitoring for any type of changes to your account.

Norton 360 with LifeLock Advantage Plan

The Norton 360 with LifeLock Advantage Plan offers everything that the Standard Plan offers but it also includes the following for $24.99 per month:

- Up to $100,000 in personal expense compensation****

- Up to $100,000 in coverage for stolen funds reimbursement****

- Up to $1 million in coverage for lawyers and experts****

This plan’s features also include:

- Alerts for any large scale breach that occurs

- Alerts for large purchases, withdrawals, and transfers through your credit card accounts, checking, and savings accounts

- Alerts for criminal reports with your personal information

- You also get an annual credit report and score from one credit bureau

Norton 360 With Lifelock Sign In

Norton 360 with LifeLock Ultimate Plus

The highest level of protection is the Norton 360 with LifeLock Ultimate Plus plan. It offers more features at $34.99 per month, including:

- Up to $1 million in stolen funds reimbursement****

- UP to $1 million in funds for personal expense compensation****

- Up to $1 million in coverage for lawyers and experts****

Norton 360 With Lifelock Cost

Its features include everything of the Norton 360 with LifeLock Advantage plan as well as:

- Investment and retirement plan monitoring

- Personal information on file-sharing networks

- Sex offender registry with your name.

- Alerts for new bank account applications that contain your personal information

- Credit monitoring for all three credit bureaus

- A credit score and annual credit report from each of the three credit bureaus

- Monthly credit score tracking

LifeLock Senior Plan

Now that you have your own plan, you can choose one that fits your family’s needs. If you have a senior that needs identity theft protection, the LifeLock Senior plan works to do this. It is $19.99 per month. It provides the same level of protection as the Norton 360 with LifeLock Advantage plan but does not include credit monitoring. It will include additional features such as:

- Home title monitoring

- Bank account takeovers

- Data breach notifications

- Fictitious identity monitoring

With this plan, your loved one’s information is accessible to you. That allows you to ensure their identity remains protected. This plan is available for those who are age 55 and older.

LifeLock Junior Plan

Lifelock With Norton Is Misleading

Even though your child may not have access to credit just yet, his or her personal information remains at risk. With LifeLock Junior, you can gain monitoring for your child’s information. This plan is priced at $5.99 per month. This coverage is available for kids under the age of 18. It provides the parent with the ability to monitor the child’s credit files and details. You will need to have an adult membership in this plan.

The LifeLock Junior plan includes protection for:

Norton 360 With Lifelock/beck

- Dark web monitoring for personal information

- Lost wallet protection

- Identity restoration support from U.S.-based specialists

- Stolen funds reimbursement (the dollar amount depends on the plan level selected in the adult plan)

- File sharing network searches

- Credit file detection, to let you know if your child’s Social Security number has been used to open an account

Utilizing all three of these allows you to create a LifeLock family plan to address each one of your needs and risks.

*LifeLock does not monitor all transactions at all businesses.

**Terms apply to all LifeLock plans.

***The credit scores provided are VantageScore 3.0 credit scores based on data from Equifax, Experian and TransUnion respectively. Any one bureau VantageScore mentioned is based on Equifax data only. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

****Reimbursement and Expense Compensation, each with limits of up to $1 million for Ultimate Plus, up to $100,000 for Advantage and up to $25,000 for Select, when purchased in Norton 360 with LifeLock plans. And up to $1 million for coverage for lawyers and experts if needed, for all plans. Benefits under the Master Policy are issued and covered by United Specialty Insurance Company (State National Insurance Company, Inc. for NY State members). Policy terms, conditions and exclusions at: LifeLock.com/legal.